Blog

May 20, 2025

Health plans and providers join forces to navigate turbulent market conditions

Multiple headwinds have created a challenging Medicare Advantage market for both health plans and providers. These headwinds include the transition to CMS-HCC V28 for risk adjustment, heightened regulatory scrutiny, increased audit activity, reimbursement pressure, shifting star ratings and evolving expectations under new CMS leadership.

Presenters at the 2025 RISE National conference suggested a unique way to address the situation: shared resources among health plans and providers to maximize compliant risk adjustment performance. You can view the presentation here or read on for highlights.

Frederick Bloom, MD, chief population health officer at Guthrie Clinic, and Hassan Rifaat, MD, executive chairman of Vatica Health’s board of directors, showed how a provider group could use its in-house clinical documentation integrity (CDI) team in tandem with an outside resource. In this case, the outside resource is a health plan-sponsored solution to assist with accurate coding and documentation. This process benefits the health plan, providers and patients.

Dr. Rifaat noted that the move away from home visits to in-office risk adjustment solutions has helped drive better compliance and outcomes because the treating PCP is in the best position to do the coding and documentation. It’s also more consistent with CMS’ mandate to improve patient care and outcomes, given the PCP’s ability to address concerns and gaps in care.

“At the end of the day, the PCP is the best person to make sure that the patient gets the highest quality care they can at the lowest cost,” he notes. “When we have primary care at the center, properly supported, it works well.

“Having the provider select codes, confirm the care plan, close care gaps and generate documentation—that’s the best model,” he continued. “The question is how to implement that on a large scale for the membership you have.”

Dr. Bloom explained how this can work best for the provider:

Dr. Rifaat highlighted how Vatica’s solution supports the provider with a Vatica-employed clinician who curates health plan and EMR data in advance of the patient visit. Conditions, open care gaps and medication reconciliation needs are presented to the provider to support a comprehensive visit. With this curated data, the physician can efficiently complete the coding and documentation. Vatica’s quality team then reviews the information to ensure accuracy and compliance.

Guthrie leadership realized that data provided via their EMR alerts contained extraneous information that wasn’t helpful for their physicians. As they explored solutions, ease of use was a primary factor. When Guthrie joined ACO Reach with 20,000 patients in the program, the need for accurate coding and documentation exceeded the capacity of the in-house Clinical Documentation Integrity (CDI) team. Vatica’s solution fit the bill, providing coding support for patients with specific insurance coverage while the in-house team handles the others.

Both Guthrie’s CDI team and Vatica’s solution are clinician heavy, not coder heavy. Many health systems have coding-heavy teams. But, as Dr. Rifaat called out, CMS has moved from coding verification to clinical validation. That is, would a physician validate and support the coding and documentation provided?

Dr. Bloom highlighted the productivity of Guthrie’s CDI team. The team’s “secret sauce” is the attention to the problem list, with CDI nurses adding diagnoses to the problem list for best results.

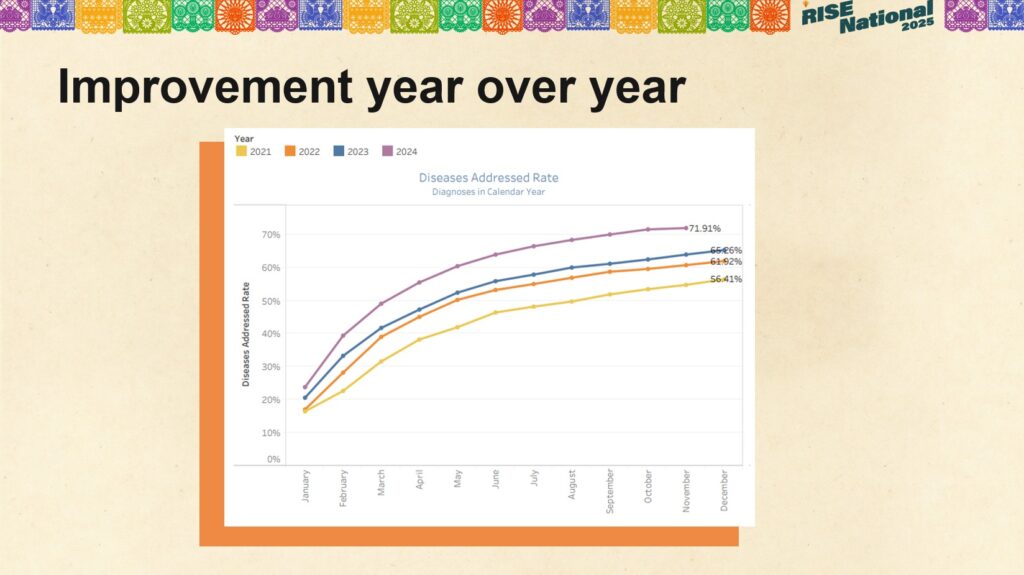

This graph from one of Guthrie’s contracted health plans shows the group’s year–over–year improvement with suspected conditions.

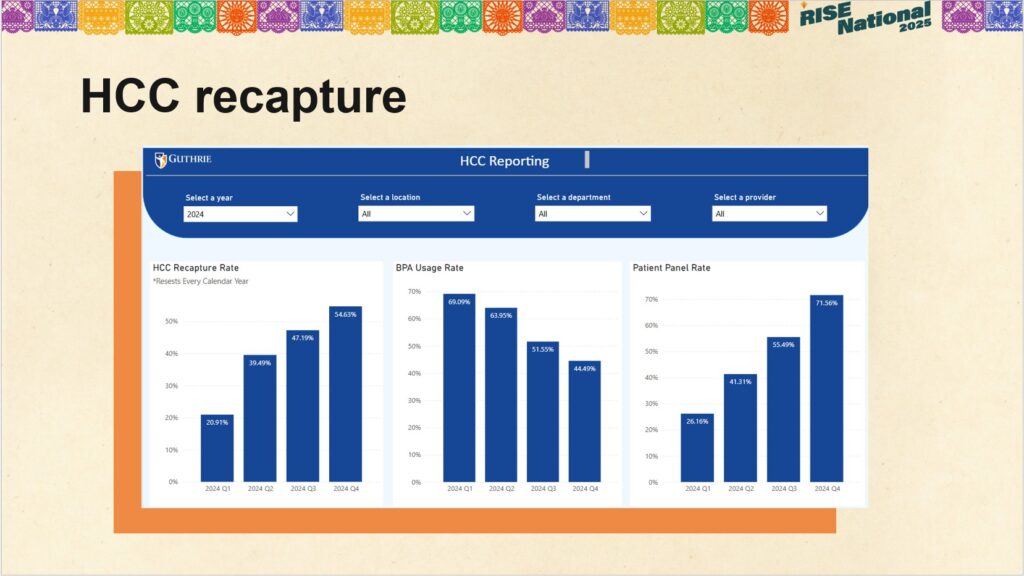

Dr. Bloom stressed the importance of feedback to providers. This graph shows the practice’s HCC recapture rate cumulative by quarter, BPA usage by quarter and patient panel rates.

Dr. Rifaat shared similar results from Vatica’s clients, with 64% of Vatica encounters in the first half of the year. Completing encounters early helps to inform next year’s bids for health plans, allows plans to identify members for high-risk care management, and provides more time to close care gaps, improving HEDIS scores. Additionally, 81% of members who have a completed Vatica visit are attributed to practices with a 70% completion rate of supported encounters. This statistic shows the value of having PCPs engaged in coding and documentation.

Dr. Bloom summarized Guthrie’s key results and learnings:

- Some of the CDI team’s work can successfully be delegated to an experienced partner.

- Focus the in-house team on patients they couldn’t get to in the past.

- Use the vendor solution for all visits, not just AWVs, to optimize results.

- Sharing recapture rate data and health plan program reimbursement with PCPs improves coding accuracy.

Dr. Rifaat offered key takeaways. He noted that in-office solutions are plentiful, but few offer both clinical resources and powerful technology. Health plans and providers should consider all users and stakeholders in their selection. Make sure the solution(s) fits with the organization’s culture and CDI strategies. Most important is provider experience. Consider clinical outcomes and financial performance. He stressed that health plans don’t have to trade high compliance for clinical and financial performance.

“Put the pen in the hands of treating PCPs with proper support and information so they make the decisions,” Dr. Rifaat concluded. “Because they are taking care of patients, PCPs will produce most accurate reporting and impact on care.”

Report

Value-based care survey

Physicians and executives give practical feedback from the front lines. To assist in your transition to VBC, learn new findings from your colleagues who are experiencing its various challenges and opportunities.

Learn more »

Resources

Read our latest thoughts

on healthcare

Subscribe to Vatica Voice

Get our latest news and insights delivered directly to you.

Adjust your approach to risk adjustment

Talk to one of our risk adjustment experts today to see how we can help you deliver better performance and stronger compliance while closing gaps in care.