Value-based care (VBC) is designed to incentivize providers to improve outcomes in a cost-efficient manner. In other words, payment and quality of care are inextricably linked. Understanding how VBC payments and penalties are calculated can help you better prepare and operationalize your VBC action plan—no matter where you are on the adoption timeline. In this article, we discuss how quality and cost intersect to help providers optimize practice performance in a VBC world.

Key metric 1: Quality

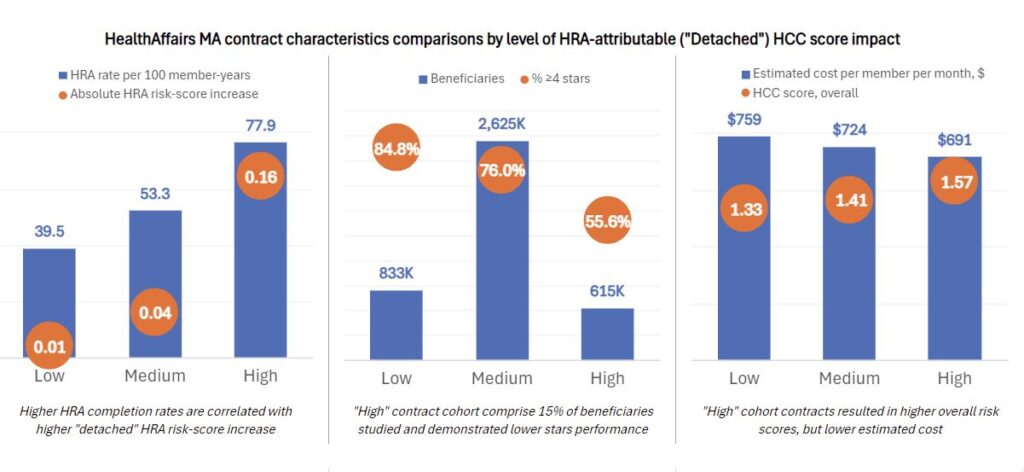

Two of the most critical components of any VBC arrangement are risk adjustment and quality reporting. This is because success in VBC depends on accurately assessing the clinical needs of your population and reporting these needs so that your payments will be sufficient to deliver appropriate care.

The challenge is that risk adjustment and quality reporting are labor-intensive and predicated on a complex set of rules, which frequently become a stumbling block for practices. Because of the complex payment methodology associated with risk adjustment, appropriate coding specificity is needed to accurately report chronic conditions. Without this specificity, plans and PCPs may end up with artificially low patient risk scores, resulting in insufficient funds to deliver adequate levels of care.

Similarly, PCPs must adhere to the reporting standards for quality gap closures. Deviation can result in sub-standard outcomes. For practices that lack specialized coding and quality technology, as well as properly trained staff, keeping up with these activities is a significant challenge.

Other measures relate to preventive health, such as ordering mammograms or colonoscopies. These routine activities are critical metrics for the health plan. Whether they’re process, outcome or preventive health metrics, it’s important that you understand all measures in your VBC programs and how they impact your financial performance.

Whether they’re process, outcome or preventive health metrics, it’s important that you understand all measures in your VBC programs and how they impact your financial performance.

Data for some measures come from standardized patient surveys such as the Consumer Assessment of Healthcare Providers and Systems (CAHPS®) or the Health Outcomes Survey (HOS). Health plans use these surveys to understand how patients feel about access to care, their perception of the quality of care at their physician’s office, and how they feel about their overall health. The questions are not related to the patient’s health insurance benefits; instead, they correspond to the care they receive from their physicians. It’s obvious how physicians influence the responses and why health plans want to partner with physicians to improve scores.

How providers are compensated

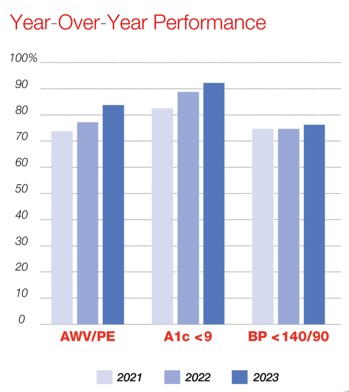

Quality of care compensation typically will be paid on a per-patient basis. For example, every time a hemoglobin A1C is ordered or you get a patient’s LDL below 100, the health plan will make a certain payment, usually on a quarterly or monthly basis.

Other VBC models involve a unique set of quality measures. Five or 10 may be needed to achieve a minimum threshold. Or seven out of 10 quality measures are needed to earn a bonus. This is typically the way quality measures are used in a model. A minimum is needed to qualify for a bonus. The bonus dollars associated with achieving a result higher than the minimum can be paid out on a per-patient basis or on the population of patients attributed to a given provider.

Key metric 2: Costs

Costs can be measured in several different ways:

- Medical loss ratio (MLR)

- Medical expense ratio (MER)

- Medical claims ratio (MCR)

All these methods involve taking medical expenses for your patients and dividing them by the premium that they’ve received for that patient. This is the risk-adjusted premium. Another way that it’s measured is by looking at the absolute cost per member—often expressed as per member per month (PMPM). Health plans take the claims expense for attributed patients and divide it by the number of patients you have. This produces a PMPM, regardless of what the measure is.

A common model uses hospital admissions, readmissions and ER visits. Those are big drivers of cost for a health plan. Sometimes, instead of using medical expense ratios or claims PMPM, plans will drive a penalty or bonus program from some of these key utilization metrics. Sometimes, those metrics will be expressed per 1,000 patients so plans can normalize that data. If your practice has 500 patients with a health plan, and there are 10 hospital admissions that month, you might see the metric described as “20 admits per 1,000.” The health plan is creating a standard across all practices so that they can compare results among practices and benchmark how each is doing. Note that some of these programs are purely based on quality, without any cost component.

A study by analysts at Harvard and Humana found Medicare Advantage members treated by doctors in advanced VBC models had 5.6% fewer hospitalizations and 13.4% fewer emergency department visits.

VBC cost vs. quality metrics

It’s important to understand both the quality and cost metrics and any relationship between them. In some cases, PCPs may need to achieve a minimum quality standard before earning any quality or cost bonus. In other cases, there are no minimum thresholds for quality; PCPs are paid as certain benchmarks are met. It matters because more and more of a PCP’s compensation is going to be tied to VBC. CMS expects all Medicare payments to go through value-based models by 2030. Those payments or penalties are calculated by using these metrics. It’s critical to understand what each of the metrics is, how the penalties or bonuses are calculated, and how you are doing today relative to the program’s maximum penalties or bonuses.

Operationalize your VBC plan

Download the full VBC white paper to learn the key action items to develop and implement a VBC program and the steps needed to improve an existing one.

Recent Comments