Effective risk adjustment drives value-based care performance and promotes fairness and equity in the Medicare Advantage (MA) program by ensuring that payments to health insurance plans and providers reflect the health status and needs of the patients.

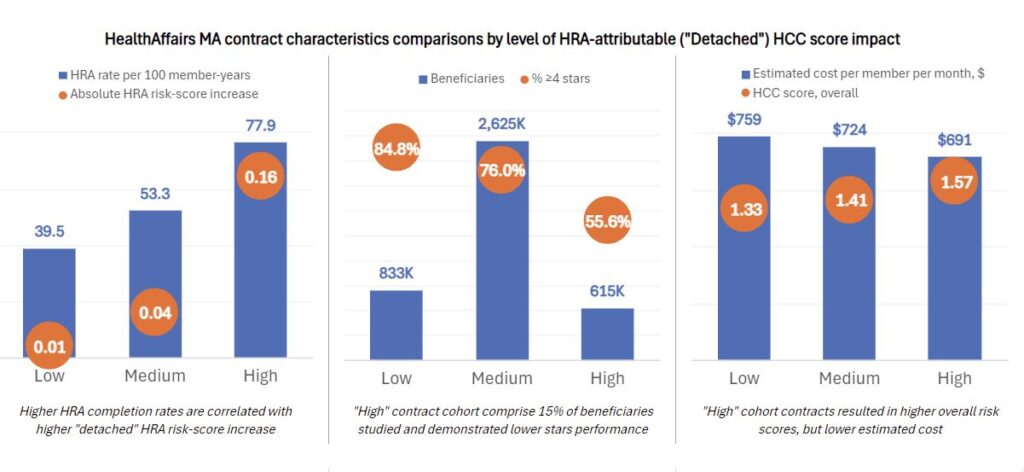

The keyword here is effective. For risk adjustment to deliver on its purpose and its promise, all parties involved—patients, providers and payers—must be coordinated and aligned. The trouble is, legacy programs, such as Health Risk Assessments (HRAs) completed by in-home assessment vendors, remain disconnected from treating providers. While HRAs can be a helpful tool in identifying active conditions, diagnoses captured in HRAs are often not recorded in a subsequent medical visit. Detached programs and practices can undermine the purpose of risk adjustment, increase the risk of non-compliance with evolving regulatory requirements and fail to adequately support and incentivize providers in their transition to value-based care (VBC).

The modern healthcare ecosystem is increasingly complex. Risk adjustment programs that exclude the Primary Care Physician (PCP) are inefficient, create provider-patient friction and amplify risk. Physicians and their teams need a risk adjustment solution that makes coding and documentation easier and leads to high-quality outcomes for their practice and their patients.

Here’s how Vatica Health’s one-of-a-kind risk adjustment and quality of care solution can complement current coding and documentation processes and enhance risk adjustment without overextending staff or sacrificing precious time and resources.

1. Prioritizes coding accuracy and completeness

Why it matters

Accurate coding is the backbone of effective risk adjustment, ensuring risk scores are calculated correctly and reflect the true health status of enrollees. HRAs, typically performed in-home by vendors on behalf of MA plans, can lead to inflated HCC scores and compromised care.

How Vatica delivers

- Point-of-care integration: Vatica works at the point of care and proactively surfaces the most appropriate and up-to-date conditions for PCPs to validate. Physicians can focus on their patient interaction, knowing they have a complete and accurate picture of the patient’s conditions.

- Holistic data collection: Unlike other solutions, Vatica collects and analyzes data from various sources, as well as unstructured data, including consult notes and medical images, offering a more comprehensive picture of a patient’s health. No need for PCPs to connect the dots between various systems and sources.

- Clinical review: With Vatica, 100% of patient encounters are reviewed by clinicians, such as RNs with advanced coding certifications. This ensures accuracy, completeness and compliance—and offers peace of mind for PCPs.

2. Works with and for providers

Why it matters

Any risk adjustment solution that providers adopt needs to reduce friction, not add to the already taxing administrative load. A flexible and user-friendly solution that meets PCPs where they are ensures effective and robust use, promoting better outcomes for everyone.

How Vatica delivers

- Provider-centric approach: Comprehensive pre-encounter work performed by Vatica clinicians arms providers with the most clinically relevant information to deliver the highest quality of care during patient visits. Providers remain at the center of care to diagnose, document and follow up.

- Workflow compatibility: Vatica’s EMR-independent technology works within existing workflows, meeting providers where, how and when they work.

- Administrative support: The unique Vatica model includes expert clinician coding support, allowing PCPs more time to deliver high-quality care and assuring that coding and documentation will be accurate, complete and compliant.

- Payer-agnostic: Vatica is payer-agnostic. Clients include most national health plans and many regional plans.

3. Supports better outcomes for patients and PCPs

Why it matters

Accurate risk adjustment is a cornerstone of value-based care. Continuing to rely on legacy programs like HRAs and chart reviews that might not reflect the true status of health—and can lead to inflated HCC scores and inaccurate risk-adjusted payments—flies in the face of VBC principles and sets providers back in their journey.

How Vatica delivers

- Help in identifying care gaps: Vatica flags open HCC coding and care gaps for PCPs to address during encounters. Real-time clinical data assists providers in addressing HEDIS measures during their interaction.

- Accurate VBC benchmarking: Vatica empowers providers to make the PCP visit the foundation for VBC benchmark accuracy. PCPs can deliver continuous, more effective care and build stronger patient relationships.

- Revenue opportunities: Vatica helps PCPs earn additional revenue through reimbursable visits, health plan incentives and enhanced VBC performance.

Better risk adjustment benefits everyone

Vatica Health’s Best in KLAS® risk adjustment solution is designed to help health plans, providers and patients achieve better outcomes, together. By increasing patient engagement and wellness, improving coding accuracy and compliance, and helping identify and close gaps in care, Vatica helps ensure that everyone benefits.

Recent Comments