Every patient has a story. The question is, are you—as the provider—telling the most important aspects of it, or are you missing critical details? We’re talking about the details that affect the patient’s health status and predict the resources required to care for them—two pieces of information that play a critical role in risk-adjusted payment models.

This article covers some common questions and topics surrounding risk adjustment and HCC coding. It is designed to help providers navigate a changing landscape.

What is risk adjustment in Medicare Advantage?

Risk adjustment promotes fairness and patient access in the Medicare Advantage (MA) program by ensuring that payments to health insurance plans or providers reflect the health status and needs of the individuals they serve. By accurately accounting for the health status of patients, risk adjustment ensures the appropriate funding is available so health plans can cover the cost to address patients’ full burden of illness. Without it, plans might be incentivized to avoid enrolling patients with complex medical needs to reduce costs.

How risk adjustment is calculated in Medicare Advantage

Provider documentation and risk adjustment

The provider—through their documentation—tells the patient’s story using the “language” of ICD-10-CM diagnosis codes. When combined with demographic data and other details, the patient’s health status becomes clearer.

Diagnostic coding plays a critical role in risk adjustment by providing more accurate and comprehensive information about the health status of individuals. If diagnostic coding is inaccurate, it can have significant impacts on providers and their patients:

- Financial implications: Under/overpayments or under/overbilling

- Compliance issues: Legal liabilities, fines and reputational damage

- Compromised care: Incorrect treatment decisions, delays or unnecessary procedures

- Healthcare system inefficiencies: Claim denials and payment delays

What does CMS-HCC stand for, and how does it work?

CMS-HCC stands for Centers for Medicare & Medicaid Services-Hierarchical Condition Categories. It is a risk adjustment model used by CMS to adjust payments to MA plans.

Specific ICD-10-CM codes map to specific HCC categories—although not all ICD-10-CM codes map to an HCC category and thus don’t affect risk adjustment. While codes that represent chronic or serious conditions with a significant impact on healthcare costs are represented, the CMS model excludes diagnoses that are vague/nonspecific (e.g., symptoms), discretionary in medical treatment or coding (e.g., osteoarthritis), not medically significant (e.g., muscle strain), or transitory/definitively treated (e.g., appendicitis).

In the CMS model, those conditions that do affect risk adjustment, which are roughly 10,000 out of 70,000+ diagnoses, are grouped into approximately 1,300 diagnostic groups (DXG) that are then aggregated into condition categories (CC). CCs are related clinically and with respect to cost. Hierarchies are imposed among related condition categories. This means that a patient is coded for only the most severe manifestation among related diseases. Hence the term “hierarchical condition categories,” or HCC. HCCs accumulate among unrelated diseases, and the model accounts for interactions between certain conditions for which costs can be exacerbated (e.g., diabetes and congestive heart failure).

The CMS-HCC model uses these mappings to calculate a risk score for each patient, which reflects the expected healthcare costs. This score helps determine the amount of funding provided each month to Medicare Advantage plans. HCCs paint a complete picture of each beneficiary’s acuity to ensure appropriate and accurate funding, effectively managing costs for high-risk members and delivering high-quality care.

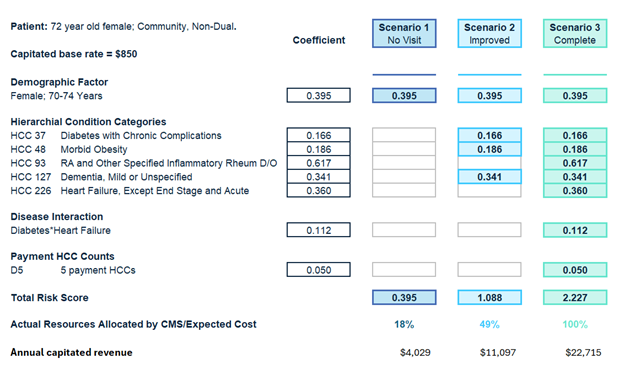

Impact of accurate documentation and code capture

Check out the example below that illustrates an $18,500+ difference in payment under the CMS-HCC model based on whether the provider captures accurate diagnoses with maximum specificity.

Figure 1. Payment by CMS-HCC based on coding specificity

Understand how the CMS-HCC Version 28 Model evolved

A new version of the CMS-HCC model was finalized in 2023 for implementation beginning in calendar year 2024. The new version, V28, replaces the most recent V24. As CMS explains, the existing HCCs that were used in the 2020/V24 model were built using ICD-9 codes, which they had to map to the newer ICD-10-CM codes while waiting for coding practices to stabilize.

For 2024, CMS undertook a CMS-HCC reclassification that involved building new condition categories from the ground up leveraging the increased specificity of ICD-10 coding, reviewing each diagnosis and determining the best grouping of diagnoses. Updating the underlying data and the clinical reclassification is meant to improve predictive ability by better reflecting current disease patterns, treatment methods and costs, and diagnosis and coding practices, says CMS. Some of the noteworthy changes include an expanded number of payment HCCs (115 from 86), changes in ICD-10-CM to HCC mapping (20% fewer codes) and adjustments in coefficient values.

V28 has been phased in over a three-year period. Per CMS: “For CY 2024, risk scores will be calculated as a blend of 67% of the risk scores calculated with the current model (the 2020 model) and 33% of the risk scores calculated with the updated model (the 2024 model). For CY 2025, we expect risk scores to be calculated as a blend of 33% of the risk scores calculated with the 2020 model and 67% of the risk scores calculated with the 2024 model, and for CY 2026, we expect 100% of the risk scores to be calculated with the 2024 model.”

The importance of accurate coding in CMS-HCC V28

Thorough and accurate documentation and coding is always important, but V28 will require even greater specificity in documentation and code assignment. Providers must adapt to the changes to ensure the health and stability of their patients and their practice.

- Proper risk adjustment: Accurate coding ensures at-risk entities receive appropriate funding to cover the care needs of their enrollees so they can deliver quality care to patients with complex health conditions.

- Financial performance: For healthcare providers and MA plans, precise coding influences reimbursement rates, maintaining financial stability and supporting the sustainability of healthcare services.

- Full health picture: Accurate HCC coding reflects the true health status of patients and enables the identification of patients who may benefit from targeted interventions like screenings or medications, ultimately leading to improved patient outcomes.

- Compliance: Inaccurate coding can lead to compliance issues, including audits and penalties, undermining a practice’s reputation and impacting its bottom line.

- Data health integrity: Reliable data is essential for public health analysis, research and policy-making. It aids in identifying trends, managing population health and making informed decisions.

- Benchmarking: Accurate data allows organizations to evaluate their performance accurately, identify areas for improvement and implement strategies to enhance care quality.

CMS-HCC coding best practices

Adhering to best practices ensures compliance, proper risk adjustment and, ultimately, better patient care. Here are some key practices to follow for effective HCC coding.

- Perform a valid face-to-face encounter. Note that telehealth visits are considered equivalent to face-to-face interactions and are subject to the same requirements regarding provider type and diagnostic value.

- Use the “DSP” acronym as a best practice guide for documentation:

- D: Diagnosis – Refers to the patient’s active medical condition or health issue that is being treated or monitored.

- S: Status – Includes the current signs, symptoms and how the disease or condition is progressing (or regressing).

- P: Plan – Outlines the course of action or treatment plan, which may include medications, procedures, follow-up appointments or lifestyle changes to address the patient’s condition.

- Link diagnoses with manifestations using a linking statement or other document.

- Add all diagnosed conditions to both the chronic problem list and assessment.

- Submit all relevant ICD-10-CM diagnosis codes, including Z codes.

- Ensure the medical record includes a legible signature with name, date and credentials

- Ensure the diagnoses being billed match the actual medical record documentation.

- Always remember the golden rule of medical record documentation.

Optimizing coding with a risk adjustment solution

One way to minimize risk and to increase revenue is to participate in a health plan-sponsored risk adjustment program that helps providers tell the patient’s story as accurately and completely as possible—all while minimizing the impact on staff and internal processes.

Recent Comments