By Shannon Lukez, Senior Vice President, Clinical Solutions, Vatica Health | This article first appeared on HFMA

The COVID-19 pandemic has heightened the need for the nation’s hospitals and health systems to gain physician cooperation in documenting and coding patient risk.

The reason is that many patients, and particularly the elderly, stopped visiting their care providers during the pandemic, often resulting in an undocumented deterioration of their health status.

Consider, for example, a 76-year-old patient with Type 2 diabetes and stage 3 chronic kidney disease, whose conditions were fully documented in the patient’s medical record and coded to the highest degree of specificity on all claims submitted in 2019. Let’s assume the patient not only refrained from visiting a physician’s office in 2020 due to COVID-19, but also was not comfortable enough with technology to receive telehealth services. Facing isolation, with severely reduced family and community support, the patient experienced growing depression and anxiety — and uncontrolled diabetes. The patient also began experiencing symptoms of high blood pressure and severely reduced access to healthy food as result of the increased financial strain brought on by the pandemic. Because the patient did not see a physician in 2020, none of this information was documented in their medical record or coded.

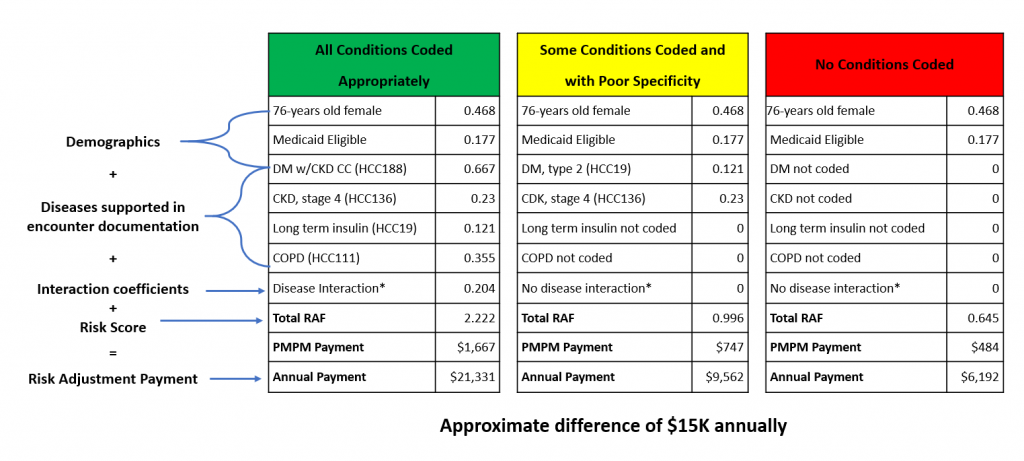

Undocumented deterioration in a patient’s health status impacts a healthcare organization’s revenue considerably. The absence of preventive care significantly increases the possibility for patient illness and premature death, while also depriving healthcare providers the opportunity to positively impact the patient’s life. Failure to recapture previously documented conditions, as well as new ones, leads to poor patient outcomes and lower levels of reimbursement.

The added challenge of physician burnout

Unfortunately, this heightened need for physician engagement comes at a time when many physicians are struggling with burnout exacerbated by the challenging work conditions created by the pandemic amid the ever-present risk of contracting the virus.

According to a 2021 national survey conducted by Medscape, 42% of physicians reported feeling burned out. Interestingly, 79% said the burnout started before the pandemic, with a majority (58%) citing “too many bureaucratic tasks” as the number-one cause.

These circumstances may cause many healthcare finance leaders to feel hesitant to add to physicians’ plates any kind of operational burden, particularly tasks related to enhanced coding, documentation and risk adjustment. It’s not easy to ask physicians — especially those who are salaried — to spend more time documenting conditions and reporting data for value-based payment programs while also increasing daily patient volume. Yet the financial future of a healthcare organization depends on its ability to delicately balance and accurately perform both tasks. As the industry shifts from volume-based to value-based payment models, healthcare organizations and physicians must cooperate to achieve long-term financial viability.

Consequences of physician burnout

Physician burnout is problematic because it leads to unsatisfied physicians and high turnover, which significantly affects patients. For example, burnout is associated with higher rates of major medical errors. It can also negatively affect patients’ access to and continuity of care as well as their care experience. All of these issues can harm a healthcare organization’s reputation and, in turn, its bottom line. For these reasons, physician burnout is an important ongoing concern for healthcare finance leaders.

How to foster physician engagement in capturing risk

Addressing these challenges requires a strategic approach to making coding and risk adjustment practices more physician friendly. Following are six strategies that CFOs should consider as they strive to support physicians in more accurately and documenting the risk profile of their patients.

1 Provide physicians with training on standard coding and documenting practices. One of the challenges associated with creating a risk-adjustment strategy is getting all physicians on the same page in terms of process and workflows. All too often, each practice — particularly one that’s newly acquired — will either have its own way of capturing risk or have no formal process at all. Consistency is important because it reduces the cost to operationalize the program, permits standardization of training and other key elements, and facilitates the establishment of expectations. Both the healthcare organization and the physicians will know exactly what is expected.

2 Align physician compensation with value-based care initiatives. Compensating physicians for their efforts is of paramount importance to obtaining physician buy-in and ongoing participation. Yet some healthcare executives contend that coding and documentation are simply part of the physicians’ role, so extra compensation is unnecessary.

This perspective does not consider newer models of care that focus on population health and outcomes, where revenue is largely determined by value, affordability and outcomes. And outcomes and value will be determined through analyses of claims and encounter data, which must be supported by accurate and thorough medical records documentation.

Aligning physician performance and compensation with overall organizational goals ensures shared accountability. Just as important, by thoughtfully designing compensation programs for both clinical and support staff, a health system can proactively counter the problems of physician burnout, declining retention and a growing shortage of talented physicians.

Paying physicians a base salary plus a gain-share bonus based on value-based care performance, for example, gives them an incentive to go the extra mile documenting for risk adjustment. It also sends the message to physicians that executive leaders are aware of the extra time and effort improved coding and documentation requires.

3 Optimize the electronic health record (EHR). EHRs, on their own, do not sufficiently support coding and documentation to optimize value-based care performance. However, solutions are available that optimize EHR performance to help identify care gaps and facilitate accurate coding.

Physicians need help with this process as risk adjustment coding is complex and cumbersome. In the CMS risk adjustment model alone, roughly 10,000 diagnoses are assembled into about 1,300 diagnostic groups that are then aggreged into condition categories (CCs). CCs are related clinically and with respect to cost. Hierarchies are imposed among related CCs, hence the term hierarchical condition categories or HCCs. HCCs paint a complete picture of each beneficiary’s acuity to effectively manage costs for high-risk members while ensuring they receive high-quality care and the organization receives appropriate and accurate payment.

Efficiently distilling this information for physicians reduces the burden on them and improves performance in value-based care, quality and risk adjustment initiatives. Healthcare organizations should work with their EHR vendors on ways to improve EHR performance to optimize the provider experience and patient outcomes.

4 Advocate for programs that remove operational burden associated with risk adjustment. For example, health systems could consider working with a health plan on a plan-sponsored program for primary care physicians (PCPs) that is easy to use and provides support to physicians. Such programs can combine powerful technology with clinical and administrative resources dedicated to medical practices.

These programs can help the participating health systems realize incremental revenue, improved outcomes, increased numbers of preventive health encounters (e.g., annual wellness visits) and improved overall performance in value-based care arrangements. The senior financial executive can initiate this strategy by reaching out to the organization’s managed care partners to see whether they provide this type of program and, if so, what type of performance reporting is included. Ideally, the health plan would provide real-time data so the physicians could understand care gaps for each patient and how well they are addressing those gaps.

If health plans don’t offer this option, the health system could consider developing a program internally, depend on its goals, available resources and competing priorities. In deciding whether to pursue such an approach without outside help, the organization would need to perform an in-depth assessment of the potential benefits weighed against the costs associated with the required upfront investment and ongoing resources for program management, analytics and reporting.

Armed with the results of such an analysis, the senior finance executive can champion the effort by communicating to the health system’s C-suite the potential financial impact of a PCP-focused program to the health system, and how it could help the organization not only survive, but thrive, in the years ahead. In this way, the senior finance leader also can help demonstrate to the physicians that there is uniform buy-in at the leadership level for a program designed to help them manage the risk-adjustment process.

5 Provide support to help physicians capture and address social determinants of health. Medical care accounts for only 10% to 20% of the modifiable contributors to healthy outcomes. The other 80% to 90% are referred to as social determinants of health (SDoH) — the conditions in the environments where people grow, live, work and age that affect a wide range of health, functioning, and quality-of-life outcomes and risks. Examples of SDoH include the lack of essential resources necessary to maintaining health, including housing and economic stability, literacy skills and access to nutritious food and physical activity opportunities. Because SDoH often can affect risk adjustment and, consequently, revenue, it is important for physicians to capture this information.

Healthcare organizations should assist physicians in this effort by providing a framework and support for capturing SDoH. Successful SDoH-focused programs include training clinical staff, providing access to local resources, developing workflows and promoting standard practices that help simplify the risk-adjustment process, including allocating time during patient encounters for these critical conversations.

6 Be transparent about the financial impact of physician performance in value-based care. Given the significant impact physicians have on a health system’s performance under value-based payment arrangements, executive leaders should share financial performance data with physicians (and potentially other staff as well). For some healthcare organizations, incremental revenue earned through participation in such programs can help them end the year in a financially positive position. Transparently communicating to physicians the financial impact of performance in value-based-payment contracts, including positive results attributed to quality and risk adjustment programs, builds awareness, trust and engagement.

A necessary charge

Value-based care is a strategic imperative for U.S. hospitals health systems, and it requires, first and foremost, physician engagement. Thus, although finance executives may be wary of asking physicians to take on the additional administrative tasks such contracts require, they must do so because success will depend on physicians’ absolute commitment to accurately documenting care and adjusting for risk. Although physicians may initially object to the additional work, they will likely become more receptive if they can be shown how better coding and documentation directly improves the organization’s financial performance — and how that translates into reduced pressures placed on physicians.

It is here where the finance leader can make a difference. By examining and implementing creative and effective solutions aimed at easing the administrative burden on physicians, the senior finance executive can help them better meet the challenge of performing documentation and coding. The result is a win-win in the form of improved value-based payments and alleviated physician burnout.

Why providers face an increased challenge in understanding patient risk

During the first six months of 2020, an estimated four out of 10 adults in the United States avoided medical care because of concerns related to COVD-19. With these delays in care came missed opportunities for hospitals and health systems to capture risk and predict costs accurately.

With the rollout of the COVID-19 vaccine, some patients are slowly resuming preventive services, which is good news. Yet this trend means providers may be overwhelmed with patients whose chronic conditions have worsened or who are newly diagnosed with a chronic condition. It is of paramount importance that the provider organizations capture these diagnoses to ensure their payment is appropriately adjusted for risk.

For patients who are still not returning to their provider, it also will be important for providers to address care gaps. Telehealth may be a great way to engage these patients so that physicians can capture risk without necessitating the need for an in-person visit.

In addition, in 2020, about 8.3 million people signed up for Affordable Care Act plans that rely on risk-adjusted payment models. This is a new population of patients for whom risk adjustment suddenly matters. Many of these patients don’t have a baseline risk adjustment factor score, making it critical to capture any and all diagnoses that affect risk-adjusted payments as soon as possible.

Recent Comments